Unlock Your Financial Future:

3-Day Virtual Training Event with Greg Herlean and Braiden Shaw

Unlock Your Financial Future:

3-Day Virtual Training Event with Greg Herlean and Braiden Shaw

Self-Directed IRA Blog: Education, News & Trends

January 15, 2026

What Are The Best Compound Interest Investments? Top 7 Picks

Compound interest investments are short or long term bank-type or money market assets. As the investment compounds it…

January 7, 2026

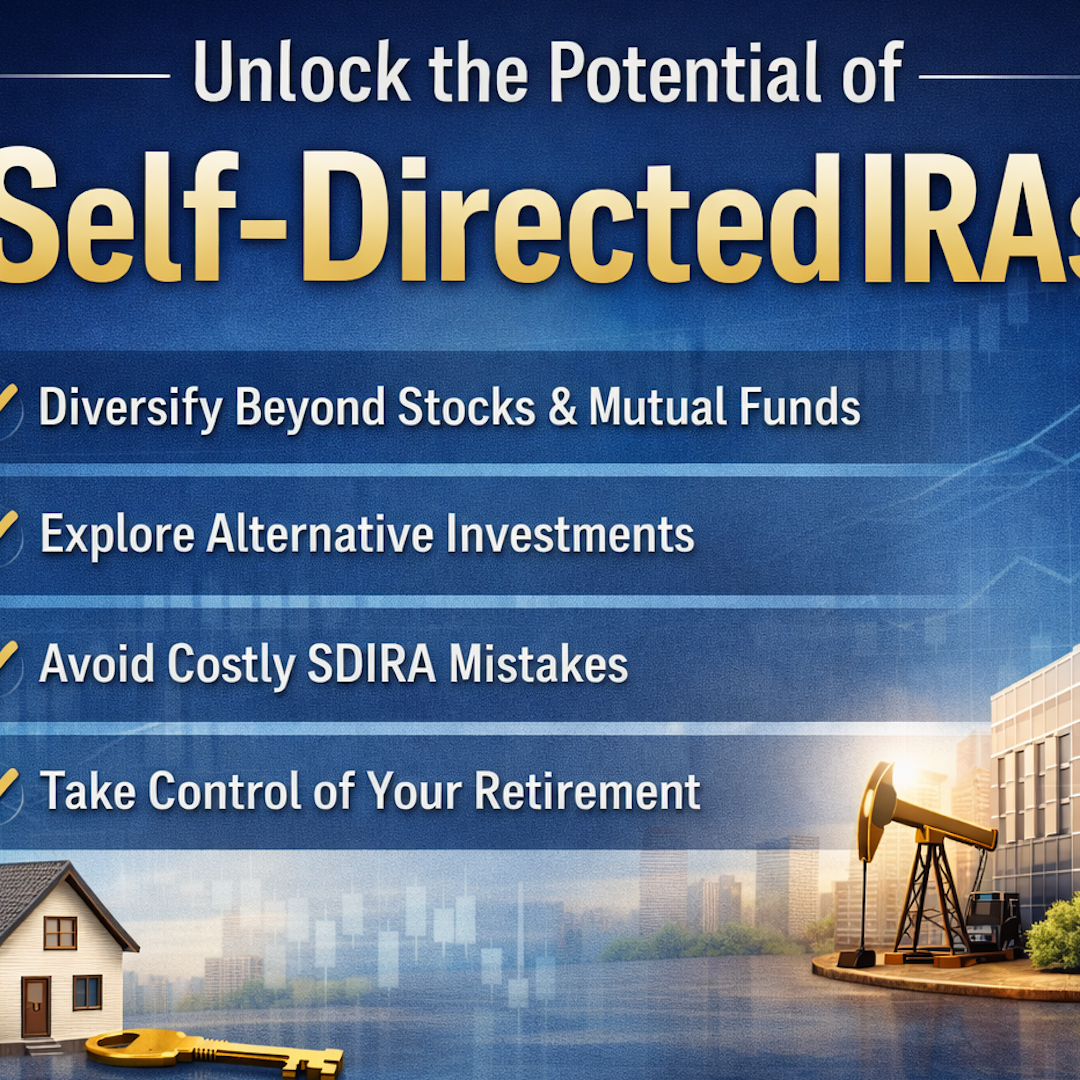

5 Common Self-Directed IRA Risks and How You Can Avoid Them

If you perform your due diligence and make yourself aware of the risks, you can build a strong and secure retirement…

December 22, 2025

What Is a Self-Directed IRA? Is It Right for Me?

SDIRA account holders oversee their investment choices. Unlike the traditional form of IRAs, there are many more types…

December 9, 2025

What Is Self-Directed Investing: Your 5-Step Guide to Get Started

With careful planning, proper research, and a little advice, you can build a diverse portfolio for a comfortable…

December 4, 2025

How to Avoid or Reduce Taxes with a Self-Directed IRA

Opening a self-directed Roth IRA is an excellent for those who want to start off saving small or wish to avoid paying…

December 2, 2025

7 Hidden Benefits of a Self-Directed IRA

There are many retirement options available, but one grants account holders control of their assets: self-directed…

November 11, 2025

Get Rid of Your Retirement Worries: Discover Self-Directed Investing

Self-directed investing is a do-it-yourself style of investing. Using your investment account, you can craft short-term…

November 4, 2025

Am I Saving Enough for Retirement?

You’re never too young to start planning for your retirement. Determine how much you want to save, hold yourself…

October 14, 2025

7 Tips for Making Money Through Airbnb Investment Properties

Airbnb properties make solid assets for your portfolio and over time, real estate investors can experience an excellent…

October 6, 2025

How Does a Self-Directed IRA Work? A Complete Guide

A self-directed IRA is an investment account overseen by you. Here's a simple overview of strategy, plan, and the…

October 3, 2025

Blockchain Technology Explained: Top 5 Reasons to Invest

Blockchain is an algorithm and data structure that facilitates cryptocurrency and other digital transactions without…

September 30, 2025

Can You Use Your IRA to Buy a House? Top 9 Questions Answered

Gearing up to buy your first home or you’re planning to move. Use your IRA to help purchase a home without suffering…