Tax compliance is a very important aspect of investing in an IRA. One tax form you may already be familiar with if you own an IRA is Form 5498.

Fortunately, many people don’t have to worry about Form 5498 because it’s filled out by their custodian. Nevertheless, this form is important in reporting distributions to the IRS and ensuring your retirement account is tax compliant.

In this guide, we’ll help you understand what kind of information you will find on Form 5498, whether or not you need it to file your taxes, and when you can expect to receive it each year.

What Is Tax Form 5498?

Form 5498, titled IRA Contribution Information, is distributed to any individual who contributes to an Individual Retirement Account (IRA). Custodians typically send a copy of Form 5498 to the IRS and the investor if they contributed to their IRA or took a required minimum distribution (RMD).

Form 5498 is completed by your custodian and typically must be submitted to the IRS by May 31. The primary purpose of this form is to report contributions, but it is also used to share other key information regarding an IRA account., including:

- The type of IRA

- Catch-up contributions

- Required minimum distributions

- Rollover contributions

- IRA’s fair market value (FMV), or the monetary value of your IRA assets.

Versions of Form 5498

There are three versions of Form 5498, and the one(s) you receive will depend on the type of accounts you have.

Form 5498

Form 5498, which we discuss throughout this page, is specific to IRA accounts. If you have a traditional IRA, Roth IRA, SIMPLE IRA, SEP IRA, or self-directed IRA, your account custodian must send you (and the IRS) this form.

Form 5498-SA

Contributions you make to a Health Savings Account (HSA), Medicare Advantage MSA (MA MSA), or Archer Medical Savings Account (Archer MSA) are reported on Form 5498-SA. Like Form 5498, the custodian or trustee of the account is responsible for filing the form.

Form 5498-ESA

If you contribute to a Coverdell ESA plan, your custodian will send you Form 5498-ESA. Coverdell ESA plans are educational savings accounts that allow individuals to contribute up to $2,000 per year per child to be used for qualified school expenses, such as tuition, books, laptops, and room and board.

Do I Have to Do Anything with Form 5498 on My Taxes?

If you haven’t taken an RMD in the previous tax year, you don’t need to do anything with Form 5498 on your taxes. Your custodian will complete and file the form with the IRS (sending you a copy). Since it’s due by May 31, you may find that you file your taxes before you receive your 5498 form.

However, if you have taken an RMD, you may need the information provided on Form 5498 to complete your tax return. If you did take an RMD, Box 11 will be checked on your Form 5498. If Box 11 is checked, you’ll need the amount shown in corresponding Box 12b, the RMD amount.

According to the IRS, your custodian must provide you with the RMD information by January 31, either by completing and issuing Form 5498 or by completing a separate form that includes the required information.

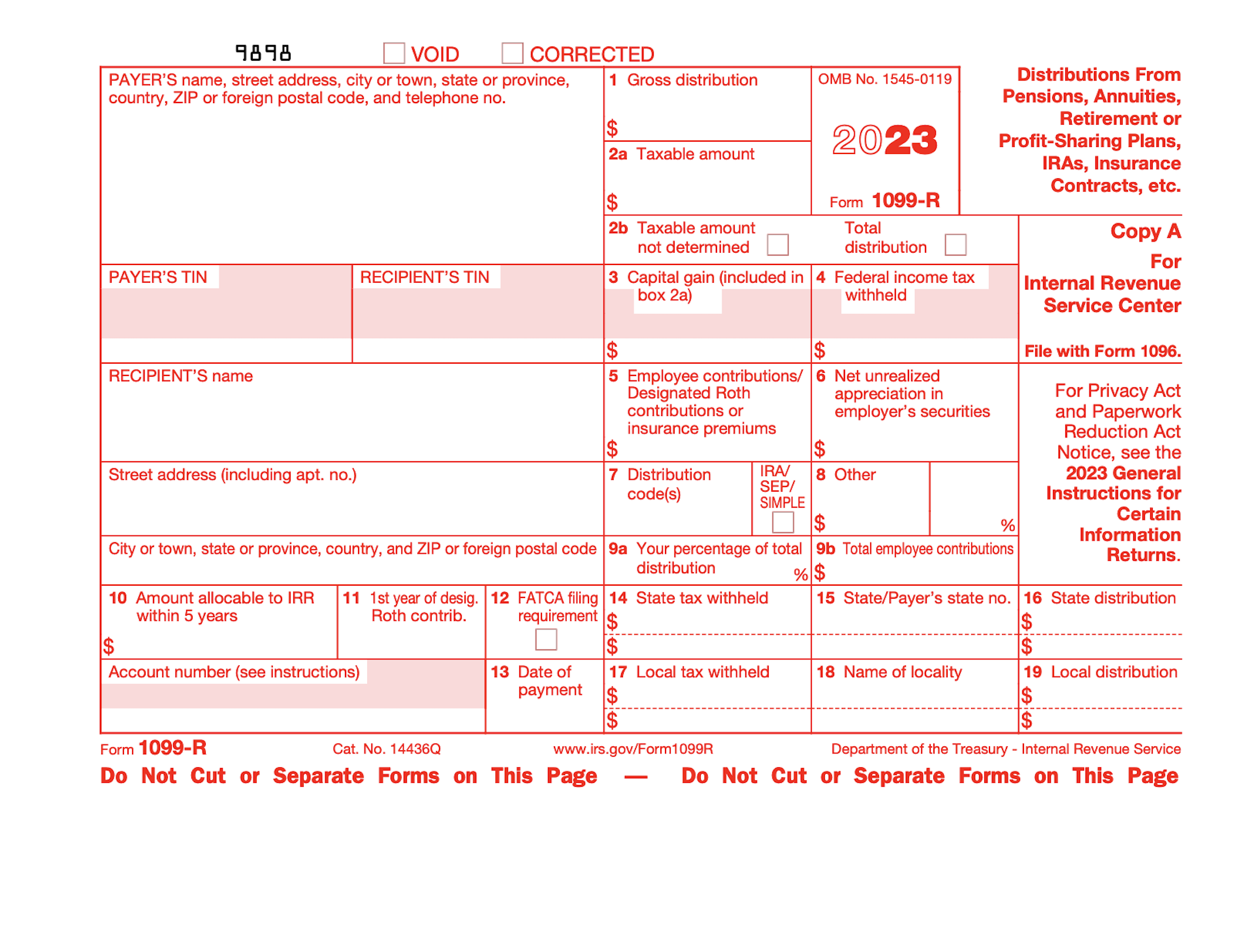

What’s the Difference Between Form 1099-R and 5498?

What’s the Difference Between Form 1099-R and 5498?

Form 1099-R and Form 5498 are both specific to IRAs, but each serves a different purpose. As specified above, Form 5498 is sent to IRA account holders and the IRS to share information about contributions. It will also include other information, like the FMV of an IRA, and whether or not the account holder is required to take distributions.

In general, a 1099-R Form is filed by a taxpayer when they receive money from an entity or individual other than their hourly or salary employer. This can include payments received for freelance or contract work, but it also includes distributions from an IRA.

Form 1099-R is used to report distributions from the IRA. And, unlike Form 5498, the taxpayer is required to file Form 1099-R when they submit their annual taxes.

Form 5498 contains available information about your IRA account. It is primarily used to transmit that information to the IRS, though keeping a copy for your records is a good idea. In addition, if you are required to take RMDs, Form 5498 can help you complete your taxes, though your custodian should be able to provide the required distribution information separately.

As an IRA custodian, Horizon Trust is well-versed in completing and sending Form 5498 to the IRS and our valuable clients. Please contact us below if you received Form 5498 and would like us to explain the information included. Our experts are happy to help.

Greg Herlean

Greg has personally managed over $1.4 billion in financial transactions via real estate investing and fixed and flipped over 450 homes and 2000 apartment units.

His aptitude for business has helped him to provide management direction, capital restructuring, investment research analysis, business projection analysis, and capital acquisition services.

However, these days he is mainly focused on being a professional influencer and educating investors about the benefits of using self-directed IRAs for tax-free wealth management. He is also a devout family man who enjoys spending his free time with his wife and children.

Greg Herlean’s journey started at 19 years old when he made a 2-year journey to Guayaquil, Ecuador, and volunteered to help less fortunate families. As a result, he learned many foundational lessons about faith, community, and hard work, which have helped him in his business success. Using these lessons, he was able to slowly build his wealth through real estate investing and establish Horizon Trust in 2011.