5-Star Rated Self-DirectedIRA Custodian

At Horizon Trust, we believe in turning dreams into reality. Founded by Greg Herlean, who has masterfully managed over $1.3 billion in real estate transactions, our mission is to empower you to take control of your financial destiny using the tax-free advantages of a Self-Directed IRA. Retire wealthy.

AS SEEN ON

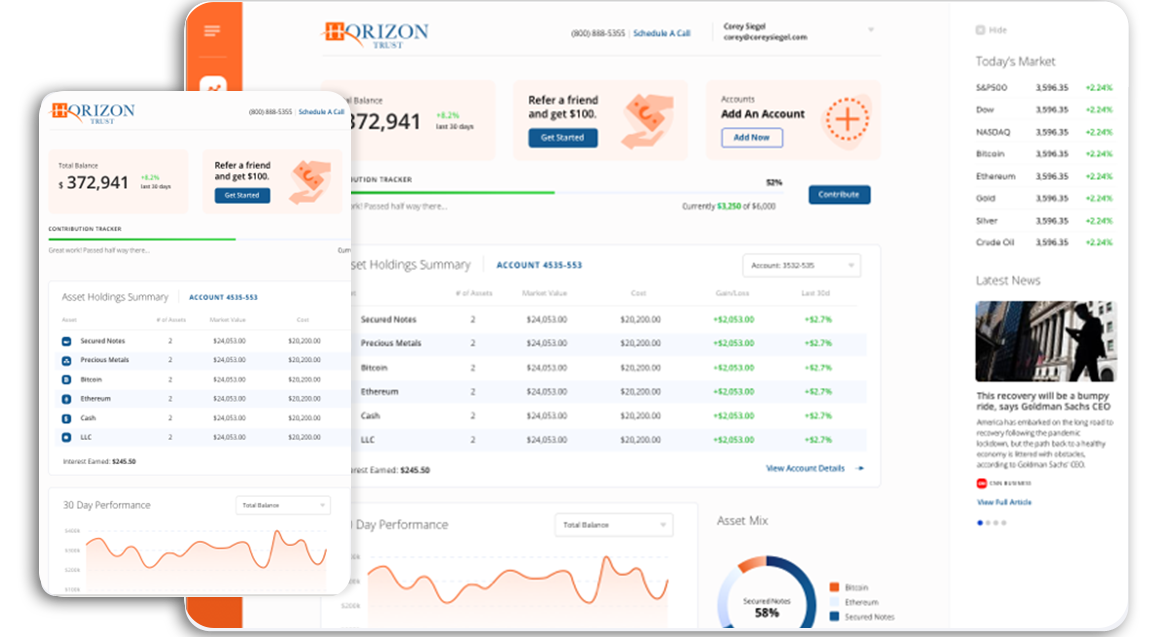

Track your asset performance with our industry-leading account portal

The Horizon Trust dashboard has all of the information you need to help you invest confidently. Some of its most important capabilities and characteristics include…

- DETAILED INVESTMENT REPORTING

- TRACKING OF A WIDE RANGE OF MODERN ASSETS

- REAL-TIME STATUS ALERTS

- DEDICATED CLIENT SUPPORT

- SUPERIOR TRANSACTION SPEED

America’s #1 most trusted self-directed custodian

4.9

4.8

4.9

Your Ultimate Guide ToSelf-Guided Success

Self-Directed IRA Blog: Education, News & Trends

Welcome to Horizon Trust’s investor blog on self-directed IRAs.

We offer expert opinion on all self-directed investment options for a secure future and relaxing retirement.

Speak to our IRA specialists today!

Talk to one of our Self Directed Specialist to discover how to accelerate your wealth by leveraging your retirement plan to maximize your returns.